Transitional Gas

Delivering a strategically located and material new natural gas province in Morocco, looking to positively impact a growing economy currently reliant on energy imports and coal.

PARTNERING WITH ENERGEAN PLC OFFSHORE MOROCCO

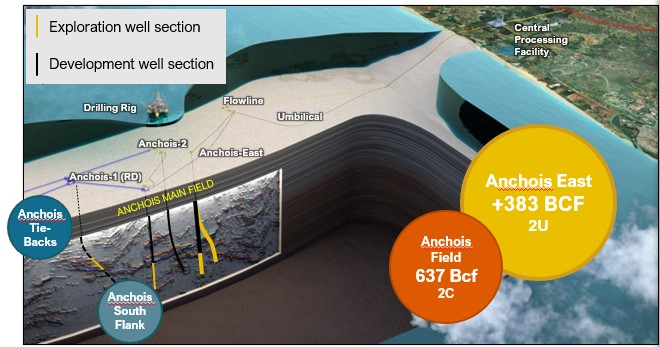

637 BCF

ANCHOIS 2C RESOURCE

754 BCF

ANCHOIS 2U RESOURCE

OPERATOR OF LOUKOS ONSHORE LICENCE

Morocco

Our Moroccan footprint

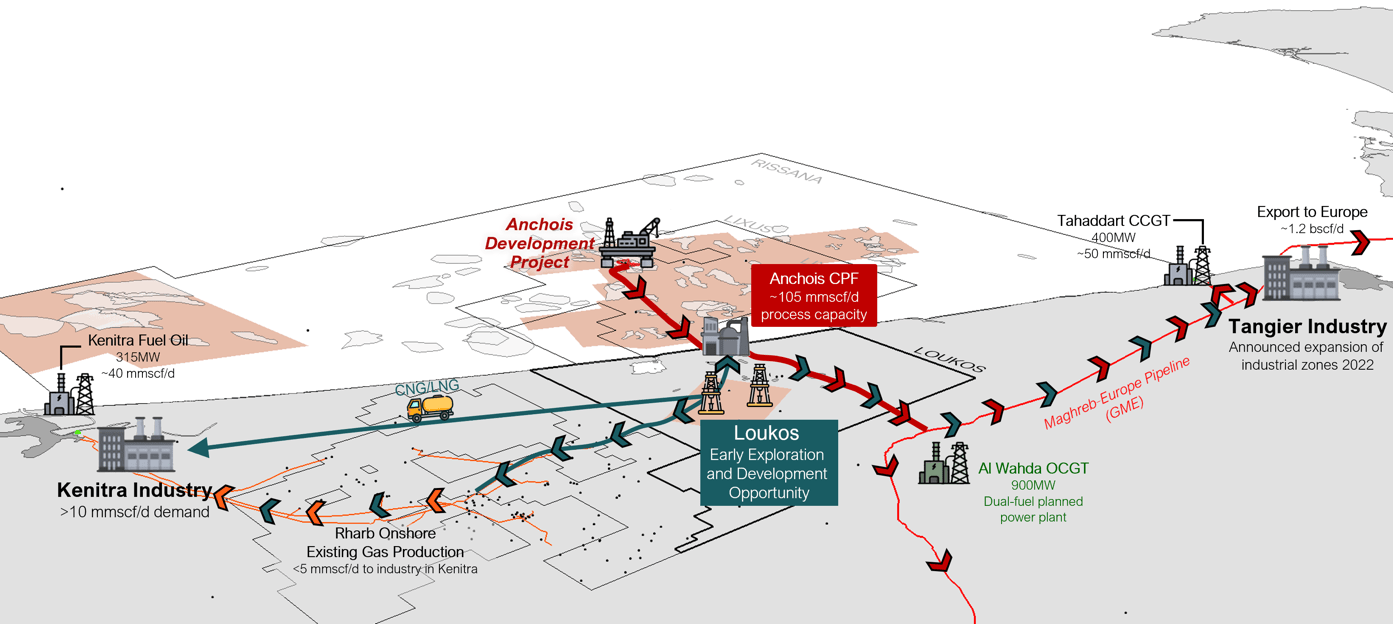

With its Transitional Gas assets, Chariot is focused on the growth and commercialisation of low-risk gas plays, ideally located to serve attractive domestic and European markets.

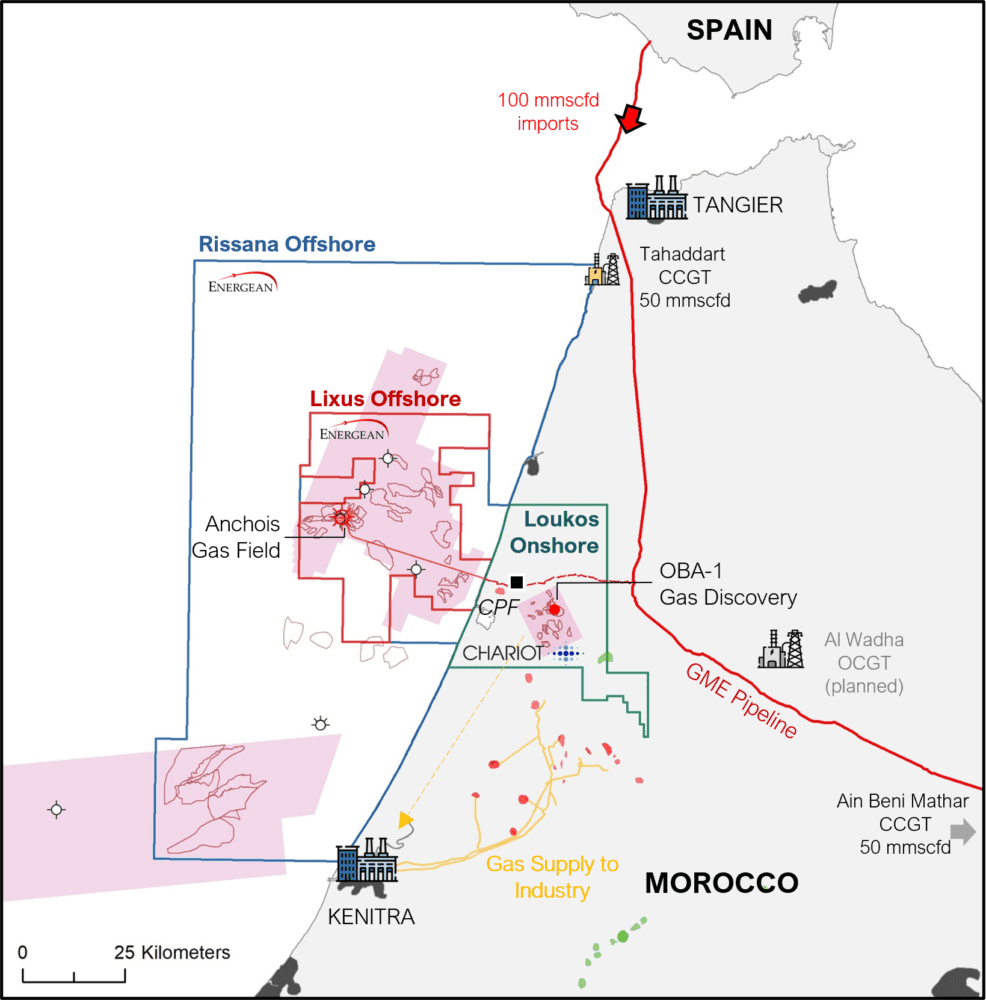

With the combined Loukos, Lixus and Rissana licences, Chariot has an enviable footprint in a Moroccan onshore, shallow water and deep water gas province with material upside potential.

Chariot owns a 30% and 37.5% non-operated working interest in the Lixus Offshore and Rissana Offshore licences respectively alongside our partners Energean, who operate both blocks with a 45% and 37.5% working interest. Chariot also owns and operates a 75% interest in the Loukos Onshore block. The Moroccan state-owned Office National des Hydrocarbures et des Mines (“ONHYM”) holds the remaining 25% working interest in all licences.

The focus of Chariot’s offshore Lixus licence is the Anchois gas development. Exploration and drilling activity on the Anchois field to date has discovered gas resources of 1.4 Tcf with an attractive follow-on prospect portfolio.

The wider Lixus licence contains significant additional prospectivity which provides opportunities for further near-field exploration activity around Anchois. Expanding the focus, future targets are abundant. Rissana’s vast expanse captures a variety of plays, with multi-Tcf potential locked up in deeper exploration targets.

The Loukos Onshore licence also offers an extensive exploration and development portfolio, optimally located to existing gas markets, and presents the opportunity to unlock a low-capex, high-value, rapid gas to industrial market solution.

The Anchois Gas Development Project

The Lixus Offshore licence (Energean, 45% and Operator, Chariot 30%, ONHYM 25%), where the Anchois gas field is located, covers an area of approximately 1,794km², with water depths ranging from the coastline to 850m.

- Anchois-1 gas discovery – previously audited total remaining recoverable resource in excess of 1 Tcf, comprising 361 Bcf 2C contingent resources and 690 2U prospective resources.

- The appraisal and exploration well, Anchois-2, drilled safely, on time, and on budget, discovered excellent quality, dry gas across seven reservoirs with approx. 150m net pay.

- Updated Independent Assessments made in 2022 provided a material increase in resources for the Anchois Gas Field, which now stand at 637 Bcf2C contingent resources and 754 Bcf2U prospective resources.

- The Front End Engineering and Design phase was completed in mid 2023 which defined the initial development plan and confirmed the commercial viability of the project

- High quality reservoir properties that mean producer wells can produce gas at high rates, reducing the associated drilling and completion costs and subsea complexity.

- Excellent gas quality, without impurities such as carbon dioxide or hydrogen sulphide

- World-class commercial contract terms with high gas prices in a developing market with growing energy demand offers a potentially high-value project

- Project financing for the development of the project being worked on by notable investment bank Societe Generale

- Material low risk exploration satellites with significant tie-back potential exhibiting a similar seismic signature to the Anchois main field

- Additional on-block exploration upside of >4.5 Tcf

- Drilling campaign commenced at the Anchois-3 well in August 2024 and was completed in September, having drilled safely and efficiently to target depths.

- Multiple gas bearing reservoirs were discovered in the B sand appraisal interval in the main hole, although with thinner associated gas pays than anticipated, and other target reservoirs were found to be water wet.

- Post-well evaluation is underway, data acquired from the other reservoirs will be useful for the understanding of the field as well as establishing the impact on pre-drill estimates and Chariot will work with the joint venture partners to determine the next steps for the project.

Primary energy demand in Morocco has doubled since the year 2000 and is forecast to double again from 2015 to 2030. In terms of power generation, imported fossil fuels dominate, with Morocco relying on imports for over 90% of its primary energy needs. The Moroccan government has been working on policies designed to improve security of supply, to provide industries access to cleaner energy at a low cost, and to minimise the environmental impact of its energy mix. As part of this process, gas has been a major factor in its vision, including the construction of further power infrastructure.

“Our offshore and onshore blocks contain a variety of exploration and development synergies which feed into a sustainable business model for the future of Chariot Transitional Gas in Morocco”

Pierre Raillard

Morocco Country Director

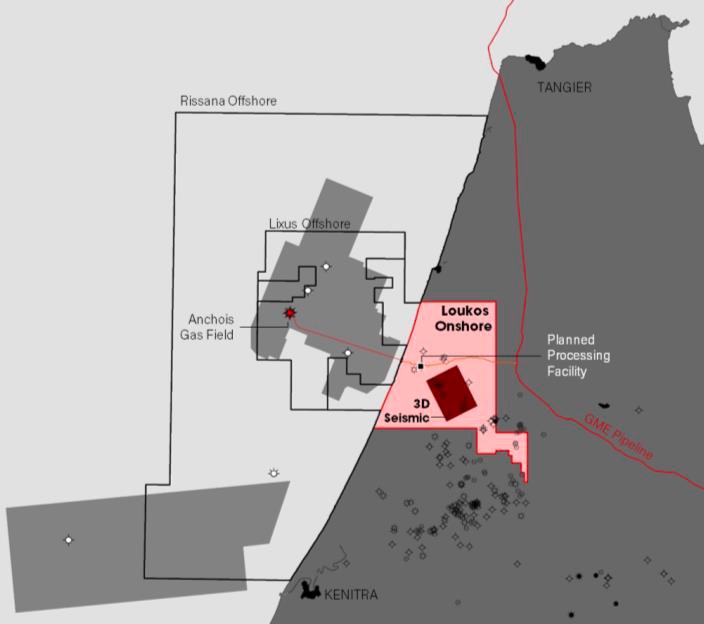

Loukos Onshore

- The Loukos Onshore licence, covering an area of 1,371km², is adjacent to Chariot’s Lixus and Rissana offshore licences; it is also the location of the planned Anchois processing facility and pipelines.

- Chariot operates the block with 75% interest and successfully completed a two well drilling campaign in May 2024 safely, efficiently, on time and on budget.

- The RKZ-1 well, drilled the Gaufrette prospect reservoirs on prognosis and although was the main target was deemed subeconomic, this well confirmed thick intervals of good quality clastic reservoir and multiple gas shows.

- The second well, OBA-1, drilled on the Dartois prospect, resulted in a gas discovery and a gross reservoir interval of approximately 70m of primary interest. This well was cased and suspended with a Christmas tree to allow for future testing and potential use as a producer well.

- Loukos contains further gas resources in existing undeveloped gas discoveries and an attractive exploration portfolio which together offer additional production opportunities.

- Data gathered from this drilling campaign and recently reprocessed 2D and 3D seismic are being integrated to update the understanding of the wider resource potential.

- Loukos has the potential to deliver early gas sales due to the proximity to a significant and undersupplied industrial gas market and recently signed a gas commercialisation agreement with Vivo Energy , a leading distributor of petroleum products in Morocco, to look to progress a future onshore gas to industry business.

- A virtual pipeline – where compressed natural gas (“CNG”) is distributed directly to customers by truck – is the most immediate, modular and low cost option to commercialise early production. This is the likely first route Chariot will initiate which will also serve as an important catalyst for future pipeline development and further growth.

Domestic Gas to Market

- Chariot’s acreage sits in a prime position to meet domestic needs, with 67% of Morocco’s GDP originating from the Atlantic coastal areas

- Gas from Chariot’s activities are deliverable to the power, industrial and export markets via a variety of potential solutions, including piped gas, leveraging off of the existing GME pipeline and existing supply pipelines in the Kenitra area, or via ‘virtual pipeline’ solutions using compressed or liquified natural gas (CNG or LNG).

- Chariot’s position to supply gas to the domestic market has been strengthened through Gas Sales Principles with the state national utility ONEE, pipeline tie-in agreements with owners, and project partners ONHYM, and a partnership with Vivo Energy, a leading distributor of petroleum products in Morocco.

- Beyond Morocco, export gas sales opportunities are also being discussed with multiple offtakers, for the delivery of surplus gas to Europe, where the desire for a diversity in gas supply has increased.

- Alongside our partner ONHYM we see a great opportunity to develop onshore gas in a lower cost, simple operating environment which would complement a future subsea-to-shore development. Commercialisation options are infinitely scalable over the longer term to meet Morocco’s growing gas needs as a priority, with the potential to rapidly commercialise surplus gas in the European markets.