Upstream Oil & Gas

Focused on building out an upstream growth business within Africa

ECONONIC EXPOSURE TO PRODUCING ASSETS

DIVERSE DEVELOPMENT AND EXPLORATION PORTFOLIO

PURSUING RANGE OF NEW VENTURES

UPSTREAM OVERVIEW

As announced last year Chariot has redefined its Upstream business widening its remit to encompass oil and gas assets and delivering a renewed, broader vision and strategy that spans the full value chain.

Our objective is to build out a balanced portfolio of production, development and exploration assets and we believe we are able to access new opportunities as one of the few smaller independent companies that has strong operating experience in Africa.

OFFSHORE ANGOLA

- Chariot is working alongside Shell Trading to support Etu Energias, a 100% owned Angolan E & P company, to secure a material interest in producing assets offshore Angola

- Chariot is providing funding to Etu Energias in connection with their acquisition of a working interest in Blocks 14 and 14K offshore Angola with production of circa 8,000 barrels of oil per day

- As a result of the Transaction, and in exchange for providing the initial funding, Chariot will be entitled to the economics associated with material production from the working interest to be acquired equivalent to up to 4,000 bopd

- In addition to the funding provided by Chariot, Shell Trading is providing an acquisition financing package of up to US$170m in return for future offtake barrels

- This marks a first step into Angola and a new era for Chariot’s upstream business by introducing an economic exposure to a producing asset with strong cashflow into the portfolio

MOROCCO

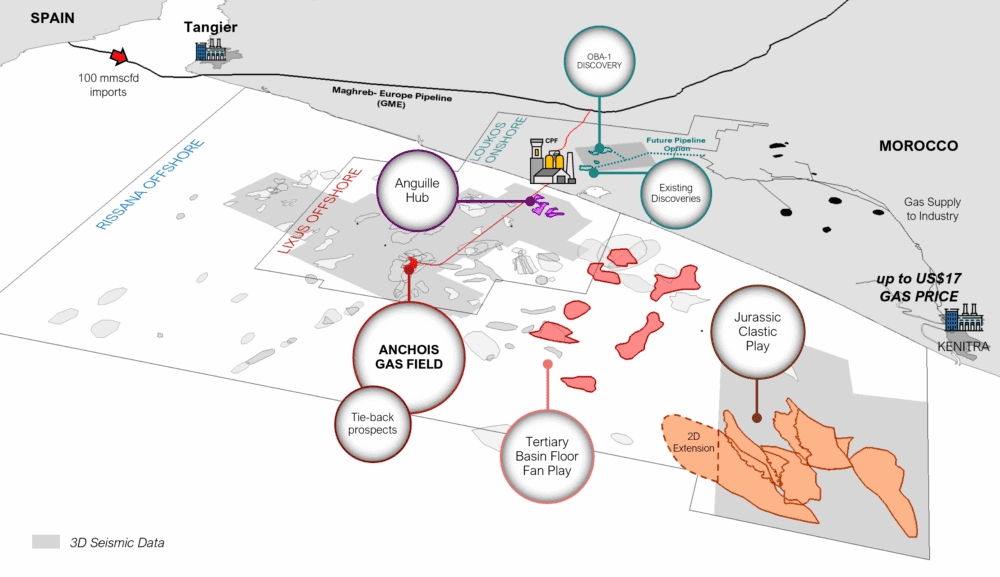

- Chariot owns and operates three diverse projects with a 75% working interest in its offshore Lixus and Rissana and onshore Loukos licences. The Moroccan state-owned Office National des Hydrocarbures et des Mines (“ONHYM”) holds the remaining 25% working interest in all licences.

LIXUS AND RISSANA OFFSHORE AND LOUKOS ONSHORE LICENCES

- Offshore, Chariot has been working on re-scoping the Anchois gas development, located in the Lixus licence, to optimise a development plan based on the core resources found in the three wells drilled to date.

- Chariot sees material economic value in this asset and there are further mapped prospects within the licence that could potentially augment production from the Anchois gas field or offer standalone development opportunities.

- The surrounding Rissana licence has a portfolio of giant scale prospects and leads, mapped in Tertiary basin floor fan plays and Jurassic clastic plays.

- There are both oil and gas targets within this portfolio, including drill-ready prospects covered by existing 3D seismic data and there has been increasing interest in offshore exploration with a number of majors exploring or looking to secure acreage in country.

- Onshore, over 100 Bcf of resource potential has been identified in the Loukos licence and the team have described multiple drilling and testing opportunities, within both existing gas discoveries as well as new opportunities.

- The strategy across Chariot’s Moroccan portfolio is to identify partners to collaborate, secure funding and progress each asset.

- Commercial fundamentals in Morocco are helped by strong market demand and attractive fiscal terms, and domestic gas has strategic value.

“We aim to leverage our management and technical team experience and network across the African continent to access high impact oil and gas projects that span the full value chain.”

Duncan Wallace

Technical Director

NEW VENTURES

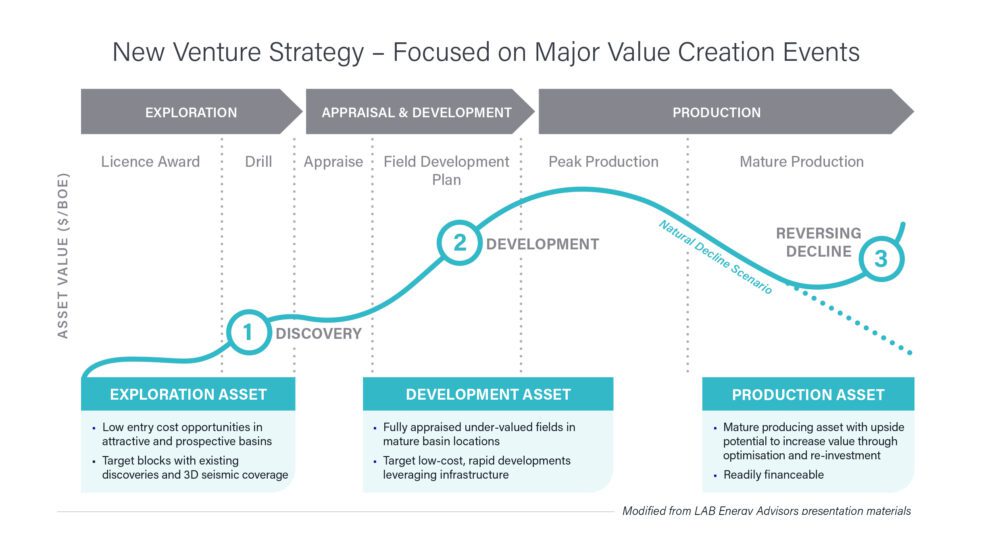

- Alongside our footprints in Angola and Morocco, we are looking for scalable new ventures across a combination of exploration, near-term development and late-life production assets where we see the biggest scope for value creation.

- We continue to pursue our interests in Namibia, where we hold a 10% back in right, but we also have a number of additional opportunities under review with a focus on high quality targets that offer low entry costs and short cycle times.

- We are focused on growth and our strategy is to identify overlooked, undervalued opportunities that may lie under the remits of larger companies but could benefit from our operating and technical experience. As a smaller sized operator, we have a niche position within this sector and with our track record of funding projects through partnering, we are accessing and evaluating a range of near-term growth opportunities.