Renewable Power

Focused on providing competitive, sustainable and reliable power solutions across Africa

ETANA ELECTRICITY TRADING LICENCE

LARGE SCALE

RENEWABLE GENERATION PROJECTS

PROGRESSING RENEWABLE POWER PIPELINE

POWER OVERVIEW

Chariot’s Renewable Power business is focused on providing competitive, sustainable and reliable energy through generating and trading renewable power in South Africa as well as progressing the development of its power-to-mining projects on the continent.

Chariot is also exploring the creation of a southern African sustainable energy business having signed a Memorandum of Understanding with ACWA Power, one of the world’s largest renewable energy companies. The partnership will aim to develop, own and operate transitional power assets across renewable energy, battery storage and gas-to-power, and the energy generated will be sold to national grids, corporate customers and energy traders.

ELECTRICITY TRADING

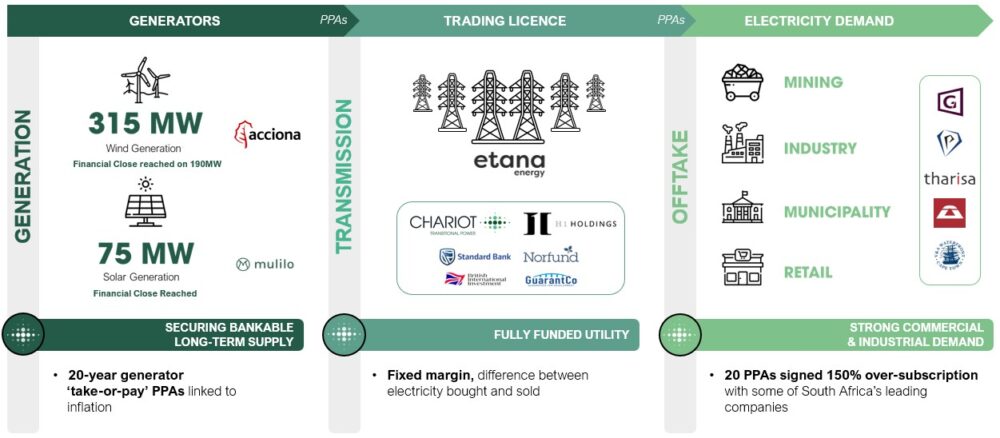

Etana Energy, in which Chariot holds an economic interest of 34% along with H1 Holdings (Pty) Limited (“H1”) (economic interest (36%)), Norfund (economic interest (20%)) and Standard Bank (economic interest (10%)), is focused on providing competitive, sustainable end-to-end energy solutions through the connecting of power generation projects to commercial and industrial users by aggregating and wheeling electricity across South Africa’s national grid. H1, which co-founded Etana along with Chariot, is a black-owned and managed company based in South Africa which has a proven track record in developing and investing in large renewable projects.

Etana has developed a “many generators to many offtakers” business model and is effectively building a new utility business as it looks to supply competitively priced, cleaner power to some of South Africa’s largest commercial and industrial users.

- Over 20 long-term Power Purchase Agreements (“PPAs”) have been signed with some of the largest electricity consumers in country including Growthpoint, Autocast, Petra Diamonds, Tharisa and the V&A Waterfront in Cape Town and work is ongoing in signing further offtake PPAs.

- The offtake of the initial generation is already oversubscribed by 50% which is indicative of the high demand and future growth potential and the ability to harness wind both day and night to complement solar energy output offers a reliable path to much needed sustainable supply for energy-intensive businesses.

- Through this platform Chariot is tapping into a wide and essential network, one that could become one of the most influential businesses in facilitating, installing, and delivering greener, competitive and sustainable energy across South Africa’s national grid over the next decade.

- This business connects efficient supply to end users through the trading platform but it also enables the development of new, renewable energy generation, in which the Power business is also participating.

- Etana is fully funded through to first revenues having secured US$100 million in guarantee finance from BII and GuarantCo and a further US$75 million in guarantee financing and equity investments from Standard Bank and Norfund in 2024.

- This financing validated Etana’s business model, underpinned the balance sheet and provided working capital but importantly, through the guarantee financing, is enabling the development of major generation projects as generators can now get a competitive price for their electricity from a bankable business which in turn allows them to project finance and build new large wind and solar projects.

- The first of these projects was the 75MW Du Plessis Dam PV2 solar project which reached financial close in March 2025 and is being constructed by Mulilo, one of South Africa’s largest independent power producers. Etana has signed its first 20-year PPA for the entire offtake.

“Major deregulation has been taking place in South Africa’s electricity market that now provides licence holders the opportunity to trade electricity to a range of high-volume offtakers as well as the opportunity to participate in new renewable energy generation projects.”

Benoit Garrivier

CEO Chariot Transitional Power

THE MARKET OPPORTUNITY

South Africa’s energy market is the largest on the continent. It has historically been controlled by the state-owned entity Eskom and predominantly relied on coal as the main source of the country’s power. South Africa has experienced significant electricity supply issues for a long time with many instances of load shedding and power outages and there is a need for new energy to fill the gap as a number of coal-fired power stations are coming to end of life.

With a forecasted additional power requirement of 30GW needed by 2030 and to address the supply and demand gap, the Government permitted private electricity generation with a focus on renewable power as a long-term energy source. The Government also granted trading licences which allows private companies to buy and sell electricity through the national grid and sell it onto customers. This wide scale deregulation created a material market opportunity and Etana was one of the first companies to apply for and receive a trading licence from NERSA, the South African regulator.

GENERATION PROJECTS

Along with growing the trading business through Etana, participating in future generation projects offers significant growth potential and securing equity stakes in these assets is a key part of Chariot’s long-term plan.

As announced in December 2025, financial close was reached on two large wind generation projects in South Africa – the Zen (100MW) and Bergriver (94MW) wind farms in South Africa, in which Chariot holds a material stake (through its newly incorporated business Chariot Generation and Trading together with its strategic equity partner, Mahlako A Phahla Financial Services), alongside Acciona Energia (lead sponsor) and H1 Holdings.

- These wind farms have a combined export capacity of 190MW of which Etana has secured the full offtake. These are Etana’s first wind projects to reach financial close and commissioning is scheduled for mid-2027

- Chariot fully financed its share in these Projects through a combination of project finance debt, third party equity investment and mezzanine debt – all arranged at the subsidiary level

- Closing this transaction was a key milestone for Chariot as this effectively created two material future revenue streams; through the stakes in these wind generation assets which will sell power and through revenues from the trading of this energy through Etana.

POWER TO MINING PORTFOLIO

- First Quantum Minerals

Alongside TotalEnergies, Chariot is progressing the development of 430MW of combined wind and solar power to look to expand Zambia’s existing renewable energy capacity and provide First Quantum Minerals with competitive and sustainable power for its Zambian mining operations. Once completed, the combined project will be one of the largest renewable energy projects in Zambia and a flagship project in the southern Africa region.The split of power will be 230MW solar PV alongside 200MW wind, and the requisite permitting and planning is underway. Further updates will follow as this progresses towards a Final Investment Decision. - Tharisa

In partnership with Tharisa and TotalEnergies, Chariot is developing the 40MW solar PV Buffelspoort project at Tharisa’s chrome and platinum group metals mine in the north west province of South Africa and work across all project development and permitting workstreams has been ongoing.The plant, to be built on Tharisa‘s property and connected behind the meter, will contribute to the company’s goal of reducing its carbon footprint, supplying around 30% of the mine’s electricity needs and substantially reducing its dependence on coal fired power. Tharisa has also signed a 15-year PPA with Etana to provide up to a further 44% of the mine’s energy demand. - Karo

In Zimbabwe, Chariot is working on the development of a 30MW solar plant, to supply competitive electricity on site at Karo’s platinum mine in Zimbabwe. Chariot is now partnering with Solarcentury to develop this project on a 50 / 50 basis and with Tharisa as a 75% shareholder in Karo, this is also linked to their carbon emission reduction targets.